Saving isn’t always easy. But it’s vitally important if you are

self-employed and you want to look forward to a decent retirement.

Saving isn’t always easy. But it’s vitally important if you are self-employed and you want to look forward to a decent retirement. With increasing longevity, it will not be uncommon for individuals retiring in their ’60s to live well into their ’90s. This will result in the need for 30 or more years of income. Add to this concern the future cost of health care, inflation and taxes, and it becomes clear that chiropractors need every tool at their disposal to make sure their finances will last for a long time and under all circumstances.

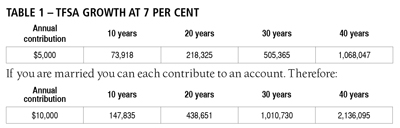

A cornerstone of your financial plan should be to create a tax-free pension for yourself. If you start early, it is not difficult to accumulate over $1,000,000, tax-free, to retire on. In addition, when combined with pension maximization strategies in retirement, it is possible to squeeze out more tax-free income than most people realize.

BACKGROUND

In January 2009, the Conservative government introduced Tax-free Savings Accounts (TFSAs). Initially, there was significant advertising by financial institutions interested in collecting your deposits. Often touted was the flexibility of these accounts. Tax-free Savings Accounts could be used to save for a car, holiday or home renovation, or as an emergency fund. Money could be withdrawn without tax consequence and be recontributed later. While these features are correct, the real magic of a TFSA has hardly been mentioned.

TAX-FREE COMPOUNDING

There is nothing more powerful than compounding income in a tax-sheltered account. It’s a simple but powerful way to create wealth, provided you have time, patience, and a little self-discipline combined with professional advice. For the first time, Canadians have access to an investment vehicle that allows them to take advantage of the full benefit of compounding.

The income we earn in a TFSA is 100 per cent ours to keep. No part of it will be taken away by taxes. We have found that once people understand the concept of how to maximize the full potential of a TFSA, they quickly embrace the idea. Here’s an illustration of what this means in terms of wealth building over time.

|

(Note: The current maximum contribution is $5,000 per year, to be indexed in $500 increments in the future; the next expected increase is $5,500 in 2012.)

Take a close look at the table on page 42.

There is a key point to take away – start as soon as possible. Compounding wealth takes time to gather speed and momentum. The earlier you begin, the more powerful it becomes and the more impressive your tax-free returns will be.

CHOOSE THE RIGHT INVESTMENT OPTIONS

Since the introduction of TFSA s, we have met with many individuals who have opened accounts on their own and have TFSA money sitting in GIC s or savings accounts earning less than one per cent interest. Not being an expert in selecting their own investments, and as a result of not being sure what to do, they have left the money in a low-interest account earning virtually no rate of return. Unfortunately, this is a wasted opportunity. Without a respectable rate of growth your tax-free pension opportunity will virtually go nowhere.

Safe investment options exist that can generate excellent long-term returns, provide lower volatility and offer creditor protection and estate planning benefits. It is a full-time job to manage a diversified investment portfolio. Traditional pension plans are trusted to professional money managers; yours should be too. The best way to ensure a proper mix of appropriate investments is to speak with a professional who understands your profession and your specific needs and desires.

PENSION MAXIMIZATION

Once you have figured out how to build a tax-free pension, your next concern should be to make sure your money lasts as long as you and your spouse do. When you are ready to retire and draw an income, traditional wisdom suggests you not spend more than four per cent of your tax-free account each year for fear of running out of money, a common concern for most retirees. You can do much better. To maximize tax-free cash flow in retirement, we suggest our clients acquire a guaranteed permanent life insurance policy equal to the expected future value of the TFSA. When they arrive in retirement, the ownership of a permanent life insurance policy gives our clients the “permission” to spend down their TFSAs over time, both principal and interest, giving them a much higher income to enjoy while alive. Upon either spouse’s death, the TFSA account is replenished with the proceeds of the guaranteed life insurance policy, leaving the surviving spouse with the account completely replaced to spend all over again. The net effect on this strategy can be a 60 per cent increase in spendable income while alive.

SPEAK WITH A PROFESSIONAL

TFSA s are a great option to build a tax-free pension. Conceptually, they are simple. You deposit money into an account and later withdraw it tax-free to use however you wish. The truth is, like many things in life, they are much more complex than they first appear. To maximize their advantages, they should be investigated and implemented with professional assistance. Don’t delay; the compound interest curve won’t wait.

Paul Philip, CFP, CLU, and Nancy Philip, CFP, CLU, are a dynamic sibling team who have been advising hundreds of chiropractors across Canada since 1992. Their firm, Financial Wealth Builders, is located in Toronto, Ontario. To learn more about building your wealth, visit their website at www.fwb-inc.com or contact Paul or Nancy at 416-497-0008.

Print this page