Opportunities and misconceptions of retirement planning

By Mike Magreehan

Features Business Finance annex Canada Pension Plan chiropractic chiropractors finance retirement retirement planning RRSP saving for retirement taxes TFSAChiropractors should prioritize the importance of planning for the future.

Photo: Getty Images

Photo: Getty ImagesFor most retirees, the thought of retirement always seems to be some destination far off into the future. But like many things in life, retirement has a funny way of approaching with greater speed each passing year.

Ten million Canadians will retire over the next 20 years. The truth is, some Canadians may outlive their savings, and research shows that this is a greater fear among retirees than dying prematurely.

Chiropractors should prioritize the importance of planning for the future, including matching retirement lifestyle expenses with various retirement income streams (variable and guaranteed). In this article we will examine (at a high level) some opportunities and common areas of misconception in retirement planning.

The benefit of time is compounded with cash flow

This thought has stuck with me: “You will experience the pain of discipline or the pain of regret. The choice is yours.” The burden of discipline is a fraction of the burden of regret. Of those living with regret, many would pay a hefty price for the luxury of avoiding regret; however, time cannot be rewound. Time is a valuable resource but if left unmanaged, it can be spent and squandered.

Where you decide to invest your time shows where you place true value. Whether it be time with family, more leisure, travel, or volunteering for a cause, these are all worthy concerns. But in most cases, the constraint of money will determine your effectiveness at fulfilling your goals. According to many academic studies, investing time today into planning your current and future financial affairs will provide fruitful returns on that investment.

It has been said that compound interest is the most powerful force in the universe. Compound returns only grow in power with time. As such, we encourage a dividend and cash-flow strategy, whereby client investment portfolios are structured so that cash-flow compounds during the working years, with the ultimate intention of paying a handsome cash-flow to one’s bank account in retirement.

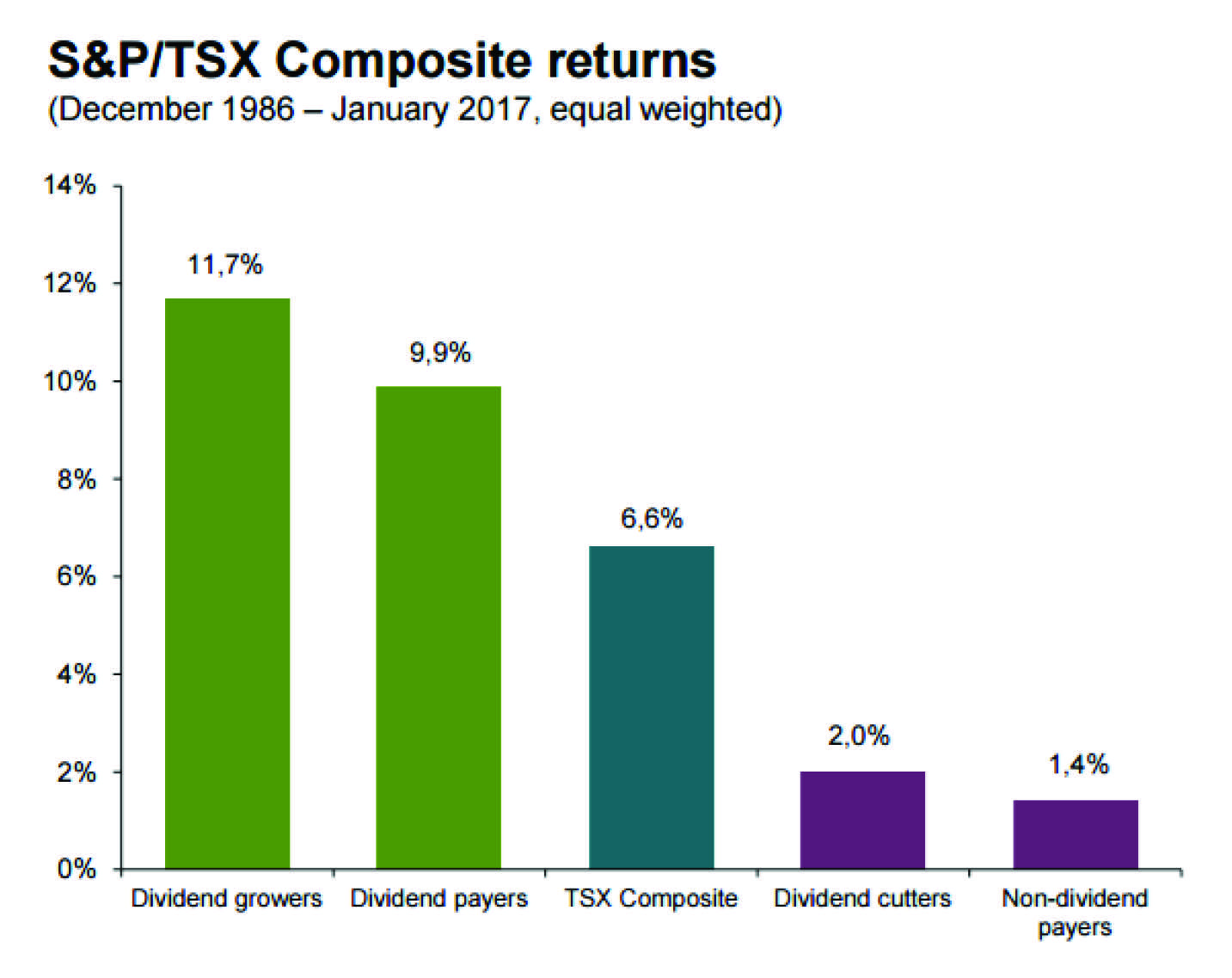

Consider the following chart, showing the returns on the Canadian market (TSX) from 1986 to current. There are a few things to note:

- Dividend-growers returned 11.7 per cent per year (i.e. companies that paid rising dividends over that time period).

- Dividend-payers returned 9.9 per cent per year (i.e. companies that paid stable dividends, but didn’t raise or cut their dividends over that time period).

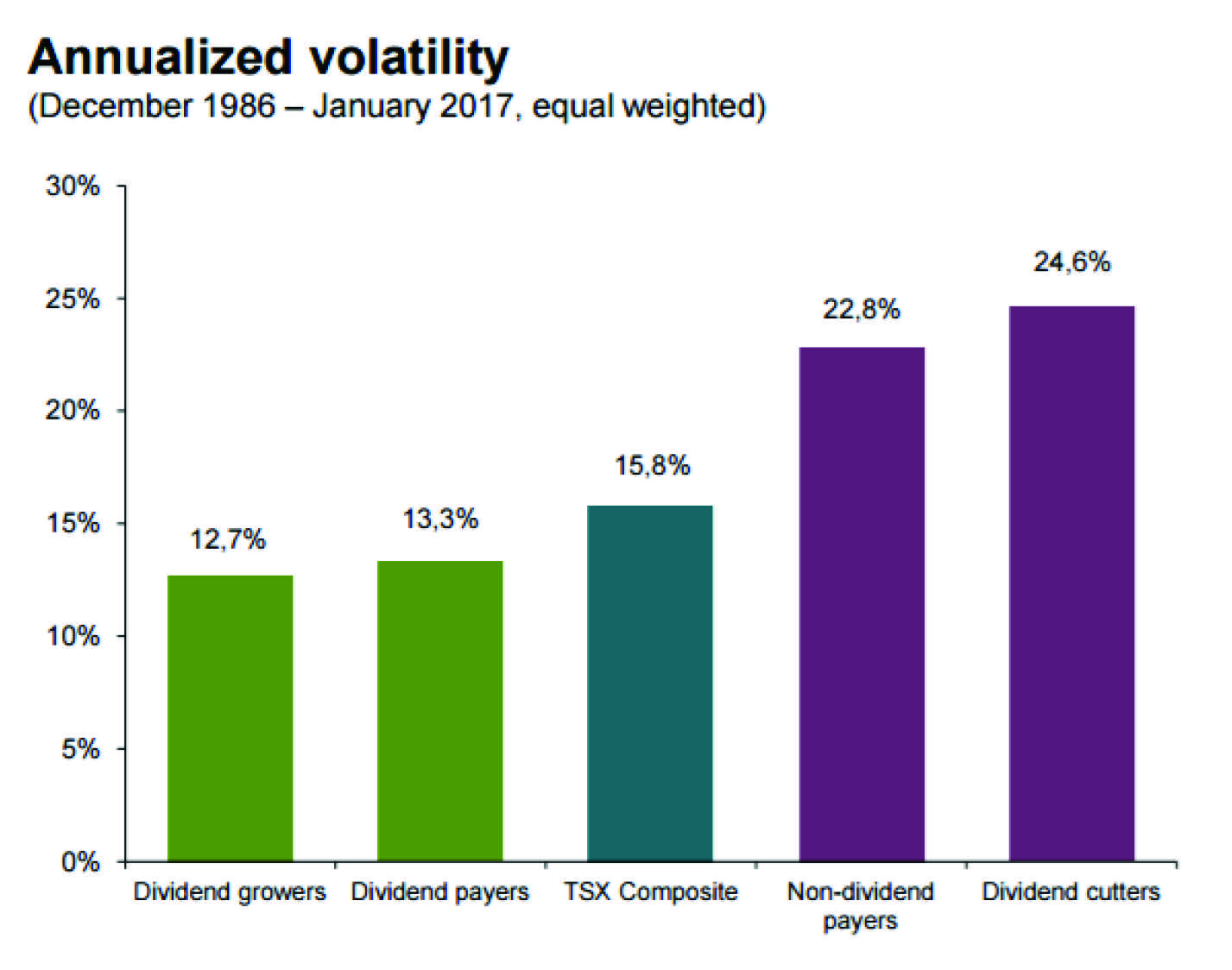

Both of these categories provided returns that beat the TSX performance, and did so with less volatility.

U.S. research firm Reality Shares, reports similar results for the S&P500. From 1972 to current, dividend-growers returned 9.84 per cent per year and dividend-payers returned 7.25 per cent per year with less volatility. In both domestic and international markets, dividend growth has been the largest component of total annualized return. Emphasizing dividend growth and cash flow is a sign of a healthy portfolio.

RRSP and TFSA considerations

The benefits of diversifying investment assets in order to reduce exposure to unforeseen risk are widely understood. A well-designed investment and retirement plan will consider such asset allocation, but will also consider the types of available account structures.

For those drawing a healthy salary, an RRSP contribution can make sense so as to earn a tax refund on dollars contributed. A well-funded RRSP complements a fully maximized TFSA strategy. A TFSA can own the same investments as an RRSP, with the added benefit that all growth and income earned inside the TFSA compound tax-free and any withdrawals are earned tax-free.

From an estate planning point of view, you are wise to name your spouse as the “successor holder” of your TFSA. Assets will simply roll tax-free into their TFSA in the event of your passing.

The surviving spouse would then be wise to name a beneficiary, such as a child. With children named as beneficiaries, your TFSA assets can pass to them largely tax-free and probate-free. To ensure maximum tax efficiency, you might consider naming contingent beneficiaries in the event your spouse and you pass at the same time.

Potential U.S. tax issues

With many Canadian retirees travelling south each year, many snowbirds may be deemed U.S. persons for tax purposes based on their length of stay.

There are many misconceptions on who is, and who is not, considered a U.S. person. U.S. persons are taxed based on citizenship as well as on residency. Some snowbirds may find themselves considered a U.S. person because they are “substantially present” in the U.S. That is, you are physically present in the U.S. at least 31 days during the current year, and 183 days during the current year and previous two years.

US taxes are a complicated matter and are beyond the scope of this article, but suffice it to say that if you are a U.S. citizen/resident living in Canada, a frequent snowbird, or own U.S. property including U.S. investments, consult with a specialized advisor to consider your best options.

Furthermore, if you are a U.S. citizen, you should discuss with your advisor the implications of owning a TFSA or RESP (or being a beneficiary thereof). These accounts are considered tax-favoured for Canadians, but they are not for U.S. citizens and the income earned must be declared.

Canada Pension Plan

Many retirees are shocked to find out that upon the passing of their spouse, they don’t receive the CPP Survivorship Pension over and above their own CPP pension. That’s because CPP rules state that the current maximum that a CPP recipient may receive is $1,114 per month.

The CPP Survivorship Pension for a person age 65 or older is 60 per cent of the deceased contributor’s CPP pension. However, if the survivor is already receiving the maximum CPP, they will earn no Survivorship Pension at all. On the other extreme, if the survivor had never worked and earned no CPP pension, that 60 per cent calculation works out to a current maximum survivor pension of $668 per month.

This misunderstood feature of the CPP has many Canadians confused or unaware, because it is unlike most pension plans. Meanwhile, this is an important consideration when deciding when to begin drawing CPP pension. Requesting your CPP Statement of Contributions from Service Canada is a prudent step to verify your personal details. A thorough financial plan should clarify the benefits and limitations to the CPP as it relates to one’s unique circumstances.

Most Canadians have not done any significant financial planning. If this includes you, don’t stress. Your best option is to start planning now. Sound financial planning strategies can be maximized and properly implemented cash-flow investments can be compounded. By embracing the responsibility of planning now, you will drastically reduce your burdens of regret in your golden years. Rather, you can approach the next chapter of your life with confidence and anticipation, knowing you have considered life’s many exciting and changing dynamics. Good advice, good solutions, great life. Here’s to a healthy retirement.

Mike Magreehan is an investment and insurance advisor with Canaccord Genuity Wealth Management in Waterloo, Ont. Mike welcomes your comments and questions at 1.800.495.8071 or mike.magreehan@canaccord.com. Visit LMwealth.com.

Print this page