Who is Warren Buffett?” If we asked a room full of strangers, chances are the majority would identify Buffett as the world’s richest man, a billionaire or a philanthropist.

Who is Warren Buffett?” If we asked a room full of strangers, chances are the majority would identify Buffett as the world’s richest man, a billionaire or a philanthropist. If we asked this same crowd of people to name Warren Buffett’s “mentor,” quite likely only a few would correctly distinguish him as Benjamin Graham.

Warren Buffett attributes much of his success to the teachings of Graham, who co-authored the bestseller Security Analysis in 1934, a book which laid the intellectual foundation for what later would be called “value investing.” Buffett was so influenced by Graham, that he even named his eldest son Howard Graham Buffett.

Success and Risk

Many would credit Buffett with being the world’s most successful investor. But success means different things to different people, and financial and business success comes in many varieties. Simply put, a person is successful because he won more than he lost. The successful investor is wealthy due to correctly identifying risk and then taking appropriate steps to mitigate it and to prevent disaster.

In defining risk, Graham distinguished between a temporary loss of value and a permanent loss of capital. A temporary loss of value in a diversified portfolio is a rebalancing opportunity to the investor that prudently sees it as such. He went on to say that a permanent loss of capital is a disaster that should be avoided. I can’t disagree – because it takes more time and fresh capital to rebuild that initial position had it not been lost in the first place. In a highly diversified portfolio where risk has been diversified away, Graham’s definition of a complete disaster is extremely rare, as we will soon see.

Throughout history, there have been many challenging periods. Temporary losses of value are frequent; at times they can become so frightening that they turn out to be permanent losses – for those who succumb to their emotions and sell.

Purchasing Power

Graham taught Buffett, as I also teach my own clients, that it is critical to focus on the free amount of “cash flow” that our portfolios generate on a consistent basis. You will notice that my articles over the past several years have focused entirely on this scientific art of investing.

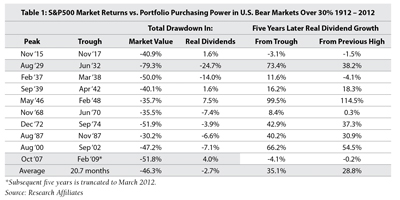

From my experience, successful wealth management is achieved by maintaining and increasing your purchasing power over time. Through the lens of Graham’s successful model of investing, such as a portfolio focused on purchasing power earned by a schedule of regular dividends, market losses are far less severe. Consider Table 1, which illustrates the 10 bear markets over the last century where the market dropped by 30 per cent or more.

Quoting Mark Twain, “history doesn’t repeat itself, but it does rhyme.” History alone can’t predict the future, but human nature is very predictable and we often fall victim to our emotions. There are so many interesting things we can learn from history and apply today.

As the table reveals, the average total market drawdown is a staggering 46.3 per cent loss in less than two years. But for those investors focusing on the level of purchasing power, by way of sustainable dividend payments, most of the temporary loss in market value was mitigated, as the loss in purchasing power was only 2.7 per cent.

Five years later, the average increase in dividends that investors earned from the companies listed on the S&P500 index actually grew by 35.1 per cent from the trough and was even accelerated by 28.8 per cent from the previous peak.

Two periods deserve special mention. The worst of these periods was the Great Depression, when the market collapsed 79.3 per cent peak-to-trough; however, the total impact on the portfolio’s purchasing power was a less severe 24.7 per cent. While this was not insignificant, it was temporary, and it was the single worst outlier of the century. Five years later, the increase in purchasing power was a whopping 73.4 per cent from the June 1932 low. Even from the prior peak of August 1929, dividend increases improved by a handsome 38.2 per cent five years later.

More recently, during the 2008 global financial crisis, U.S. stocks tumbled 51 per cent but their dividends increased by four per cent during that period.

|

|

glass half empty or half full?

With all the media noise and speculation, it is easy to conclude that curling up into a ball is the least painful approach. Dramatic price moves and the substantial volatility of recent years are why many people struggle with the current market. But by taking a glass-half-full view, through the lens of a five-year time horizon, as Buffett and Graham both instruct, we see that portfolios focused on purchasing power recovered by an average of over 30 per cent.

In almost every period, dividend payments continued and went on to make new highs. There are countless examples of companies that have consistently increased their dividends through bear markets; these include utilities, pipelines, banks, consumer staples, infrastructure and technology stocks, and the list goes on.

I enjoy my relationship with clients who experience our portfolios’ accelerating dividend payments, directly translated into increased purchasing power. This is especially critical today when inflation continues to nip away.

Investing takes discipline. It doesn’t have to be fancy, but it must be well thought out. Retirement often lasts several decades, and portfolios that increase their cash flow are essential to maintaining your purchasing power for an extended time.

Disclaimer: Canaccord Wealth Management is a division of Canaccord Genuity Corp, member – Canadian Investor Protection Fund. The views in this article are solely the work of the author, and not necessarily those of Canaccord. The information herein is drawn from sources believed to be reliable (Research Affiliates), but its accuracy and completeness is not guaranteed, nor in providing it does the author or Canaccord assume any liability.

Mike Magreehan, CFP, is an investment advisor with Canaccord Wealth Management in Waterloo, Ontario. Mike welcomes your comments and questions at 1-800-495-8071 or mike.magreehan@canaccord.com.

Visit www.LMwealth.com .

Print this page