A successful retirement income plan helps ensure that your assets will

last throughout your lifetime. That, of course, is predicated on

knowing how long you are going to live.

Longevity

A successful retirement income plan helps ensure that your assets will last throughout your lifetime. That, of course, is predicated on knowing how long you are going to live. Based on today’s higher average life expectancies, plus the possibility that an individual may live well past the average, chiropractors need to plan for 20, 30 or even 40 years of retirement. If they do not, they run the risk of outliving their savings.

|

|

Statistics indicate that a man who has reached 65 years of age has a 50 per cent chance of living to age 83 and a 25 per cent chance of living to age 89. For a 65-year-old female, those odds rise to a 50 per cent chance of reaching 86 and a 24 per cent chance of living to 92. The odds that at least one member of a 65-year-old couple will live to age 90 are 50 per cent. And there is one chance in four that one member of that couple will live to 94.

A Few Tools That Can Help – RRSPs, TFSAs AND RESPs

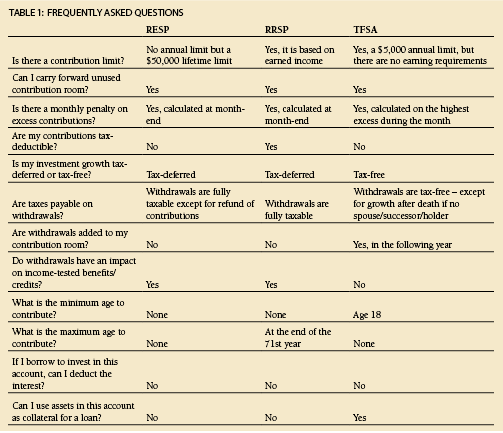

When it’s time to decide which mix of savings vehicles is right for you, your options can start looking like a bowl of alphabet soup. There are Registered Retirement Savings Plans (RRSPs), Tax-free Savings Accounts (TFSAs) and Registered Education Savings Plans (RESPs). Determining which savings plan, or combination of savings plans, is best depends on your personal situation and your objectives.

Until 2009, most chiropractors held their retirement savings in an RRSP, where they could claim a deduction for their contributions and then defer tax on withdrawals until retirement. The introduction of TFSAs has provided another powerful savings vehicle that allows investment growth to accumulate and be withdrawn at any time tax-free. Unlike an RESP, you cannot claim a tax deduction for the contributions you make to a TFSA. On the plus side, if you need to withdraw money from your TFSA, you have an opportunity to replace that money because all TFSA withdrawals are added back to your unused contribution room in the following year.

If you have children or grandchildren, RESPs are another popular option. The contributor makes contributions on behalf of a beneficiary (the child). The contributions are not deductible or taxable on withdrawal. The growth is tax-deferred until withdrawal at which time it can be taxed in the beneficiary’s hands if he or she enrols in a qualifying educational program. Contributions to a child’s RESP qualify for the Canada Education Savings Grant (CESG) and, if your family’s income is below certain thresholds, you may also qualify for the Canada Learning Bond (CLB).

The Retirement Dilemma

If you are saving for retirement, then you may be torn between an RRSP and a TFSA. Ideally, you would maximize contributions to both, but if that’s not an option, here are some thoughts to consider.

Whether the best choice is to save in an RRSP or a TFSA, depends on your savings needs, as well as your current and expected future financial situation and income level.

Generally, an RRSP is used for saving for retirement, while a TFSA can be used for both saving for retirement and other shorter-term purchases.

|

|

| Trying to work out retirement strategies on your own can be confusing and time consuming, and often produces limited results.

|

If you are in a low tax bracket, saving in a TFSA may be more advantageous than saving in an RRSP since TFSA withdrawals have no impact on federal income-tested benefits and credits such as child tax benefits and Old Age Security. On the other hand, RESPs may be a better option if your tax rate, at the time you contribute, is higher than it will be with you withdraw your savings. You’ll benefit from a tax deduction when you make your contribution and withdrawals will be taxed at your lower future rate. If the reverse is true, a TFSA can provide better results.

Education Savings Choices

If you are saving for your child’s education, then you are probably weighing the pros and cons of an RESP or a TFSA. Contributions to an RESP for a child under 18 years of age qualify for the CESG mentioned above, which pays 20 per cent of the annual contributions you make, up to a maximum of $500 per year, per beneficiary – or a maximum of $1,000 if there is unused grant room from a previous year – to a lifetime limit of $7,200. (You may be entitled to an enhanced CESG if your family’s income is below certain thresholds.) Thus, for children under 18 years of age, RESPs are preferred savings vehicles because of the CESG. For children over age 18, the CESG no longer applies, so you may want to help them start their own TFSAs. If you want to maintain control over the funds, then you could save for their education in your own TFSA instead.

There are many different savings options and strategies available today. Trying to do it yourself can be confusing and time consuming, and often produces limited results. Successful retirement planning is similar to chiropractic care. It involves a process of working with an expert who uses a holistic approach. To be most effective, find an advisor that clearly understands your profession. This will allow the advisor to focus and properly assess and evaluate your current situation, define where you need to be, and recommend appropriate strategies to help get you there.

For article with references, please see www.cndoctor.ca.

|

Print this page