Retirement. That wonderful time of our lives we all look forward to.

Retirement. That wonderful time of our lives we all look forward to. Our working days are behind us and we finally have the chance to do all those activities we really enjoy. But, often, the biggest questions on our mind are, “Will I have enough money and will it last for my entire lifetime?” These questions are especially of concern for self-employed individuals as they don’t have a defined benefit pension (a stream of income that is guaranteed to continue for their entire lifetime).

Consider the case of twin sisters, Jane and Amanda. Both Jane and Amanda are chiropractors who have built successful practices. By incorporating their practices, they pay themselves a salary while leaving any excess income to grow in their corporations as retained earnings. Their personal savings are invested in RRSPs and TFSAs, while their corporate savings are invested in a portfolio of non-registered mutual funds held in their company names. In retirement, their income will be a combination of their personal savings and corporate retained earnings, along with the proceeds from selling their practices. Jane and Amanda’s parents lived well into their ’80s, so both want to ensure they have enough money to last their entire lifetimes.

Fast-forward to retirement and Jane is enjoying this new stage of her life. Although she didn’t accumulate as much in savings as her twin sister, she feels good about her nest egg. She wakes up every day looking forward to this new chapter in her life. She has the time and income to spend on her hobbies, with family and friends, and traveling to places she wasn’t able to when she was working. Her income consists mainly of a guaranteed income stream she previously set up for herself using some of her retirement savings.

Because of this wise investment choice, Jane knows exactly what her monthly income will be, making it easy to plan for her financial expenditures with the peace of mind that she can’t outlive her savings. She does have other investments but, because she’s not totally dependent on them for her regular income, she only reviews them once a year with her financial advisor to see if any changes need to be made. She rarely pays attention to all the market volatility that is going on. Jane is thoroughly enjoying her stress-free retirement.

Now contrast Jane and her situation with her twin sister, Amanda, who arrived at her retirement at the same time. Amanda saved really hard during her working years and was able to accumulate a larger nest egg than Jane. Unfortunately her days are nowhere near as stress-free as Jane’s. She is constantly worried about all the daily financial decisions she needs to make. With the recent market volatility, she checks the paper daily to see how her investments are doing in order to determine how much she can safely withdraw from her portfolio each month. She calls her financial advisor at least once a week to check on her account. But he isn’t always available, and especially not in those late-night moments when she is most worried. Amanda does have a portion of her portfolio invested in the safety of GICs. This investment gives her some comfort but, with the current low interest rates, the after-tax income is not enough. Considering the longevity in her family, she also frets that she may not have enough money to last her lifetime. Every financial decision she makes is very stressful for her. She wants to spend more time doing all the little things she enjoys but doesn’t feel able to relax enough to truly embrace her retirement.

Which twin is better off and happier?

The answer, of course, is Jane.

SO WHAT DID JANE DO DIFFERENTLY?

As Jane approached age 50, she began to worry more and more about what a volatile stock market could do to her investment portfolio in the years leading up to her retirement. Jane decided to meet with her financial advisor to discuss her concerns. She had two questions she wanted to address:

- Are there any pension options available to her to ensure her day-to-day expenses would be met?

- How can she tap into her corporate savings in retirement?

Jane’s financial advisor explained that new products were available in Canada that could provide retirees with a guaranteed income stream similar to a defined benefit pension. Jane could purchase a Guaranteed Withdrawal Benefit (GWB) product, an investment fund that guarantees an annual retirement income stream for as long as she lives, no matter how the underlying investments perform – even if the underlying investments go to zero. This product would protect against market volatility, allowing her the ability to benefit from any up-markets without experiencing any downside risk. He explained that being self-employed without a defined benefit pension, it would be wise for her to “pensionize” a portion of her savings into a GWB product.

Jane liked this idea but wondered if she should invest now or wait until closer to retirement. Her advisor explained that this product was designed to help Canadians prepare for retirement well ahead of time and works especially well for those aged 45 and over. In fact, because of the way the product works, she’d actually have a higher income available to her the earlier she invests. In other words, the sooner Jane made the investment – and the longer she left it alone and refrained from taking income – the larger the amount of retirement income that will be available to her when she retires. He explained it’s an ideal way to make sure Jane has enough money to cover her retirement expenses, and she doesn’t need to invest in more volatile equities to meet her objectives. Best of all, it’s guaranteed for life.

Her advisor explained that a GWB product would also work extremely well with her corporate retained earnings. She could transfer her current corporate investments into a GWB product and continue to invest some of her excess corporate income into the product until she was ready to retire. Thereby producing a larger income stream in retirement. And because the funds are non-registered she could enjoy some tax advantages when she was ready to withdraw income.

Jane liked that she wouldn’t have to worry about outliving her savings and, similar to a defined benefits plan, this product

would offer her the comfort of knowing her day-to-day expenses would be met. She decided to “pensionize” both a portion of her RRSP and a portion of her corporate retained earnings. This would mean that when she was ready to retire, her income would consist of a personal guaranteed income stream, a corporate guaranteed income stream, CPP and OAS, and supplemented as needed by her other investments.

In contrast, Amanda’s personal and corporate savings remained invested in a portfolio of mutual funds, stocks, bonds and GICs. As a result, Amanda’s main source of retirement income is dependent on current interest rates and how well the markets are performing. In addition, she has the nagging fear that her savings may not last her entire lifetime. Amanda’s retirement days are filled with ongoing worry while Jane’s are enjoyable and relatively stress-free.

|

SPEAK WITH A PROFESSIONAL

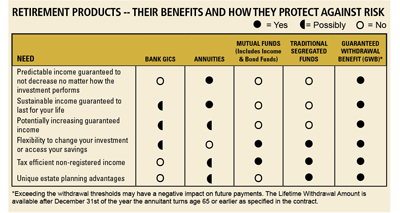

Refer to the table earlier in this article (page 32) for a comparison of retirement products and how they protect against risk. If you have questions about how you are going to fund your retirement years,

speak with a qualified advisor. He or she can provide you with the help you need to ensure you are financially ready for retirement when the time comes. Don’t wait. It’s never too early to plan.

Paul Philip, CFP, CLU, and Nancy Philip, CFP, CLU, are a dynamic sibling team who have been advising hundreds of chiropractors across Canada since 1992. Their firm, Financial Wealth Builders, is located in Toronto, Ontario. To learn more about building your wealth, visit their website at www.fwb-inc.com or contact Paul or Nancy at 416-497-0008.

Print this page