We all know the “Duck Test” – if it looks like a duck, swims like a duck, and quacks like a duck, then it probably is a duck.

We all know the “Duck Test” – if it looks like a duck, swims like a duck, and quacks like a duck, then it probably is a duck. This test is of great assistance in determining whether the relationship between a clinic and a chiropractor or other professional/service provider is an employment relationship, or whether the relationship is an arm’s length independent contractor relationship.

Clinic staff could comprise a mix of employees (from whose wages/salaries the clinic owner makes “source deductions” such as income tax and Employment Insurance premiums) and independent contractors (responsible for their own deductions and usually collect GST-HST). A chiropractor’s resumé could include stints as both.

There are various advantages and disadvantages to working as either, or having employees or contractors at your clinic. A contractor can be terminated on very short notice (e.g., 15 to 30 days), whereas employees are entitled to much more generous severance entitlements (up to 24 months’ notice or pay in lieu thereof). Employees have their payroll paperwork and source deductions handled for them by the clinic, but contractors handle their own. Contractors can opt out of CPP in some cases, and can deduct business-related expenses at tax time that an employee cannot. Employment relationships and working conditions are governed by a complex web of legislation, whereas contractor relationships are much less regulated, except by private contract between the parties.

so, is it a duck?

Are you certain that you’ve entered into the type of relationship you believe you have? What you call yourself or what someone else calls you is completely irrelevant. You may believe your relationship is exactly as specified on the piece of paper you and another party have signed. If so, it may come as a surprise that in the face of a dispute or controversy, the inquiring authority – whether it is the Canada Revenue Agency (CRA), the courts or a government tribunal such as the Ontario Labour Relations Board – will definitely look beyond what’s stated on that piece of paper to determine the actual legal relationship. That is, what’s written in a contract is a factor, but it’s rarely determinative.

How does one go about determining whether the clinic-chiropractor relationship is one of employment or contract? One applies the appropriate variation of the Duck Test – and if the chiropractor walks like an employee and talks like an employee . . . you guessed it.

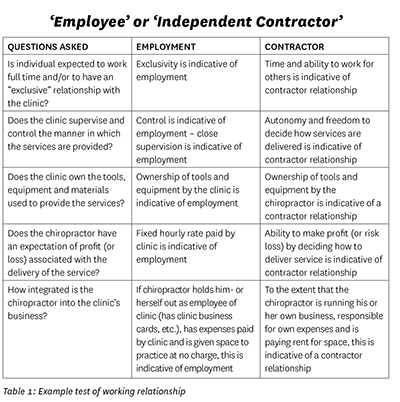

There are several factors involved in this examination. As described in Table 1, employees are usually paid a fixed hourly rate or salary, are covered by benefits, work a specified number of hours per week, and report to a supervisor who oversees and controls their activities. Typically, employees also have a job title and a clinic business card, use the clinic’s equipment and have business expenses paid by the clinic. However, if the individual makes decisions about how services are rendered and charged, is paid on a revenue-sharing or other variable basis, is not covered by benefits, decides when to work, works for other clinics or offers independent services to non-clinic clients, works autonomously (free of supervision), covers his/her own business expenses, has his/her own business cards, uses his/her own equipment and pays rent for the space to practice, the person is more likely to be considered a contractor.

Exclusivity, degree of control, ownership of tools/equipment, risk of profit/loss and the degree of integration of the chiropractor into the clinic’s business are key factors in determining the type of relationship. An inquiring authority will examine all factors and make a global assessment. Keep in mind also that depending on the inquiring authority (a court versus the CRA), or the purpose of the inquiry (e.g., to determine whether the individual is owed damages for wrongful dismissal versus a determination of whether or not back taxes are owed), a slight variation of the test will be used. The determination may also vary slightly from one province to the next.

|

THE ‘DEPENDENT CONTRACTOR’

To further complicate things, it’s possible to have a contractor relationship but one in which the contractor is dependent on a single clinic for most or all of his/her income. In such cases, the clinic’s relationship may be deemed to be with a “dependent contractor.” Legally, a dependent contractor is treated very similarly to an employee in terms of things like entitlements at the time of terminating the relationship. As is always the case, this type of relationship is determined through looking at all the test factors, but the degree of economic dependency is crucial. The more economically dependent the chiropractor is on a single clinic for income, the more likely he or she will be seen as a dependent contractor.

Whether you are a clinic owner/manager or a chiropractor working as what you believe to be a contractor, you should consider these test questions carefully. Although the popularity of contractor relationships has soared over recent decades, many such relationships are improperly characterized by the parties themselves. Unpleasant scenarios can result from not having the relationship clearly determined by both parties. For example:

- A contractor, who for several years has positioned him/herself as such (invoicing you month after month and perhaps collecting HST), sues you for wrongful dismissal when you terminate the relationship on short notice, now claiming to have been an employee all along.

- The CRA decides deductions relating to the work a particular chiropractor ought to have been made “at source” (by you, the clinic) and not only seeks repayment of outstanding taxes and deductions, but also imposes penalties and interest.

- An “employment standards officer” determines that your contractors are employees, and possibly owed vacation pay, overtime pay and public holiday pay.

It’s in everyone’s best interests to ensure the nature of the relationship is certain, and that everyone thoroughly understands their respective obligations and entitlements. Analyzing your relationships now and taking any steps to clarify them will help you avoid unpleasant surprises or disputes down the road. If you have contractors who “quack” like employees, you may wish to take steps to transition them into an employment relationship using a contract that captures the parties’ mutual expectations with respect to issues such as termination. For this, we strongly recommend that you seek legal assistance.

|

|

|

Lior Samfiru, LLB, heads the Labour and Employment Law practice at Samfiru Tumarkin LLP. Samfiru represents and advises both employees and employers with respect to all workplace matters.

Chuck Tahirali, MIR, is a senior human resources consultant and an integral member of the Labour and Employment Group at Samfiru Tumarkin LLP.

Print this page